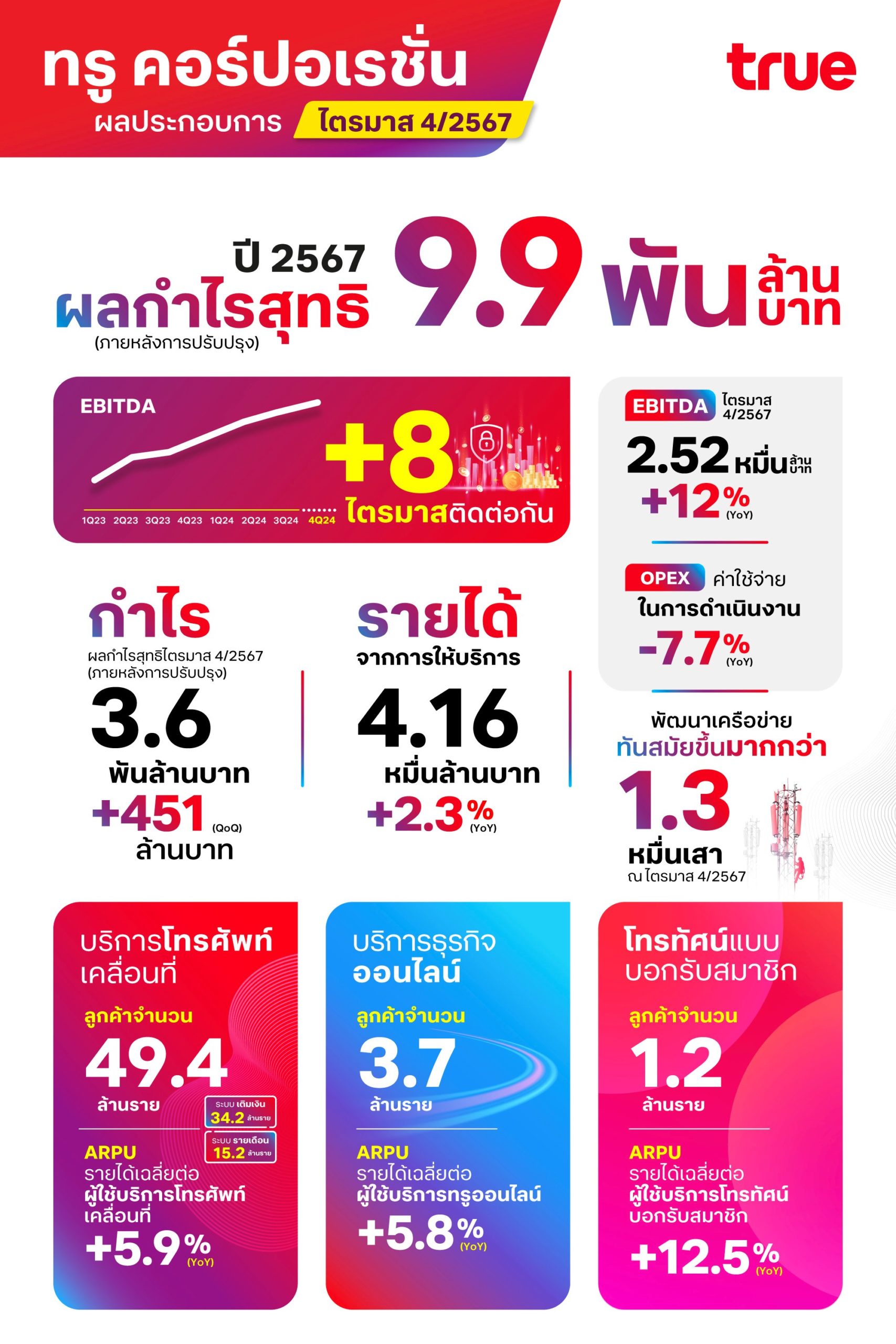

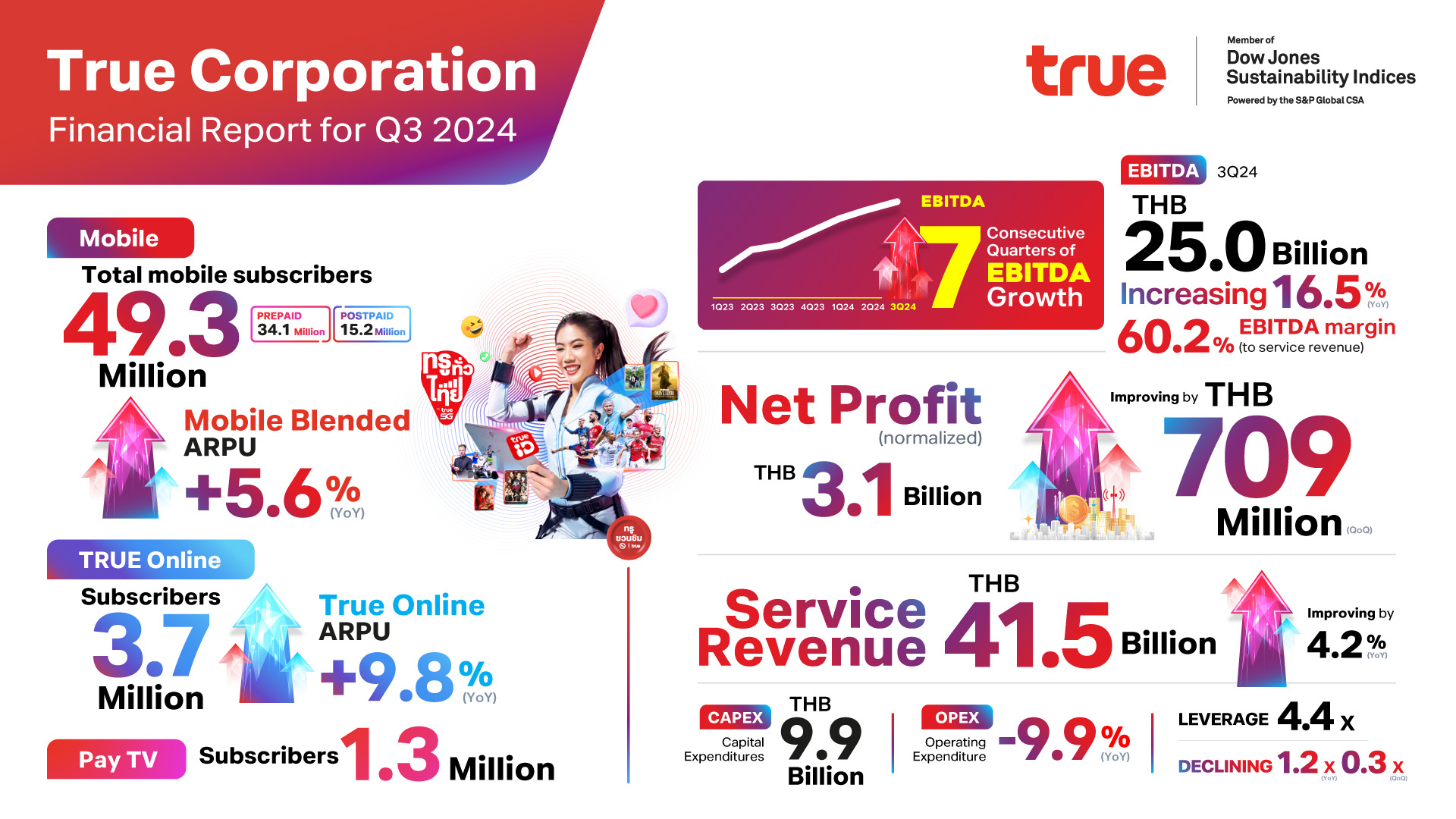

February 20, 2025 – True Corporation Plc. reported continued profitability for Q4 2024, recording 3.6 billion baht in normalized net profit after tax. EBITDA improved for the eighth consecutive quarter, driven by reduction in operational expenses from a performance focus and financial discipline along with ongoing benefits from synergies. Service revenue and EBITDA performance surpassed the guidance set for the full year 2024.

Mr. Manat Manavutiveth, Chief Executive Officer of True Corporation Plc., said, “Despite the economic headwinds of 2024, True Corporation has demonstrated resilience and strong execution, delivering sustained profitability and EBITDA growth for the eighth consecutive quarter. This success is driven by three key factors. First, we accelerated network modernization with over 77% of integration completed—ahead of schedule. Once we achieve 100% completion by mid-2025, this nationwide network integration will mark a historic transformation, unifying two major networks into one. Customers of both TrueMove H and dtac will experience significantly enhanced performance firsthand. Second, we strengthened global partnerships to enhance technological capabilities. Third, we leveraged AI and advanced analytics to optimize network performance and drive digital innovation. As we navigate the challenge of balancing efficiency with growth, we remain committed to delivering greater value to stakeholders while reinforcing our position as Thailand’s leading telecom-tech company. Beyond business performance, we take pride in being recognized as the world’s most sustainable telecom organization, ranking number one globally in the 2024 Dow Jones Sustainability Indices (DJSI) for the seventh consecutive year.”

Mr. Sharad Mehrotra, Deputy Chief Executive Officer of True Corporation Plc., said, “In 2025, True Corporation will deliver the best network experience in our history, with exceptional service quality nationwide. Furthermore, we are elevating our customer service by implementing AI as a key driver, offering personalized service recommendations, instant assistance through our virtual service agent ‘Mari,’ and supporting our sales and call center agents with AI co-pilots. In 2025, we aim to increase our digital service users from one-third to 40% and expand our digital user base to 20 million. Our refreshed service app will allow customers to easily check bills, receive privileges, and access AI-powered services, all in one place. 2025 will be a year of profitability, delivering customer delight through True’s success.”

In Q4 2024, mobile subscribers returned to positive growth quarter on quarter, increasing by 116,000, or 0.2% from the previous quarter, reaching 49.4 million. Mobile subscriber numbers were negatively affected by efforts made on scam prevention in collaboration with law enforcement to the effect of 133,000 subscribers. Mobile postpaid subscribers were flat quarter on quarter to 15.2 million while prepaid subscribers reached 34.2 million. Online subscribers registered an increase of 0.5% quarter on quarter, reaching 3.7 million. At the end of Q4 2024, 5G subscribers reached 13.8 million.

Mr. Nakul Sehgal, Chief Financial Officer (Co) of True Corporation Plc., said, “2024 has been a monumental year for True Corporation with a turnaround to normalized profitability in the very first quarter, exceeding our expectations. Keeping up with the ongoing momentum since amalgamation, we reported eight consecutive quarters of growth in EBITDA along with consistently improving profit every quarter. For the full year, True reported a normalized profit of 9.9 billion baht, with 3.6 billion baht recognized in the fourth quarter.”

Service revenue excluding interconnection revenue improved 2.3% year on year in the fourth quarter, with full year 2024 service revenue registering a growth of 4.6%, surpassing guidance. Service revenue improvement was driven by top-line improvement across all business segments and continued rationalization in mobile and online segments. True Corporation reported total revenue growth of 0.8% year on year. The improvement in service revenue which was driven by ARPU uplift in all segments was partly off-set by lower product sales revenues due to rationalization of subsidies.

For Q4 2024, total operating expenses excluding depreciation and amortization declined 7.7% year on year, benefitted by the realization of synergies and ongoing financial discipline. Network cost declined 0.8% year on year driven by continued synergy related savings from network modernization and procurement. Selling, general, and administrative expenses (SG&A) declined 22.3% year on year benefitted by synergies mainly from organization modernization, commercial initiatives and improved collections. Through integration of performance management framework with focus on sustainable profitability, True Corporation has consistently kept operating expenses well controlled.

True Corporation recorded an EBITDA improvement of 5.8 billion baht since the amalgamation, marking eight consecutive quarters of EBITDA growth. For the fourth quarter, EBITDA improved by 12.0% year on year and 1.0% quarter on quarter, while EBITDA for the full year of 2024 improved by 14.5%, surpassing guidance. The growth in EBITDA was driven by topline improvement, synergies, and financial discipline. EBITDA to service revenue improved to the highest level since amalgamation at 60.6% in Q4 2024.

In Q4 2024, True Corporation recorded costs from one-time items amounting to 11.1 billion baht resulting in a net loss after tax of 7.5 billion baht. The one-time non-cash items pertained to impairment of assets related to network modernization and obsolete inventory, annual impairment of goodwill and investments, and loss from investment in associates. True Corporation also recorded a cash provision on account of compensation to local authorities to be paid in 2025. Normalizing for these one-time costs, net profit after tax amounted to 3.6 billion baht, an improvement of 451 million baht from the previous quarter, driven by improvement in EBITDA and reduction in financial costs. CAPEX for the fourth quarter of 2024 amounted to 11.4 billion baht, mainly focusing on network modernization.

For the outlook of full year 2025, the Management of True Corporation expects to deliver between 2 – 3% year-on-year growth in service revenue excluding interconnection revenue and domestic roaming with NT, between 8 -10% year-on-year growth in EBITDA, while CAPEX including integration is expected to be between 28 – 30 billion baht. True Corporation expects to be profitable on a reported basis in 2025 with dividend consideration of more than 50% of consolidated net profit subject to the approval of the board of directors.

Key Financial Indicators for FY24 and Q424

Service revenue excluding IC:

- THB 165.9 billion for FY24, improving 4.6% YoY

- THB 41.6 billion in Q424, improving 2.3% YoY and 0.2% QoQ

EBITDA:

- THB 98.1 billion for FY24, improving 14.5% YoY

- THB 25.2 billion in Q424, increasing by 12.0% YoY and 1.0% QoQ

EBITDA margin (to service revenue):

- 2% for FY24

- 6% in Q424

Net profit (normalized):

- THB 9.9 billion for FY24, improving by THB 14.7 illion YoY

- THB 3.6 billion in Q424, improving by THB 0.5 billion QoQ

About True

As Thailand’s leading telecom-tech company, True Corporation empowers people and businesses with connected solutions that advance society sustainably. True’s world-class voice and data services enable a lifestyle ecosystem of global entertainment, exclusive privileges, and seamless connectivity. Through our AI-augmented innovation, we contribute to a more productive, healthier, and safer world.