- Continuous growth in EBITDA demonstrates strong synergies since amalgamation and integration of performance-focused culture

- Nearly 10 billion baht in investments in Q3, including network modernization that reached a milestone of 10,000 sites

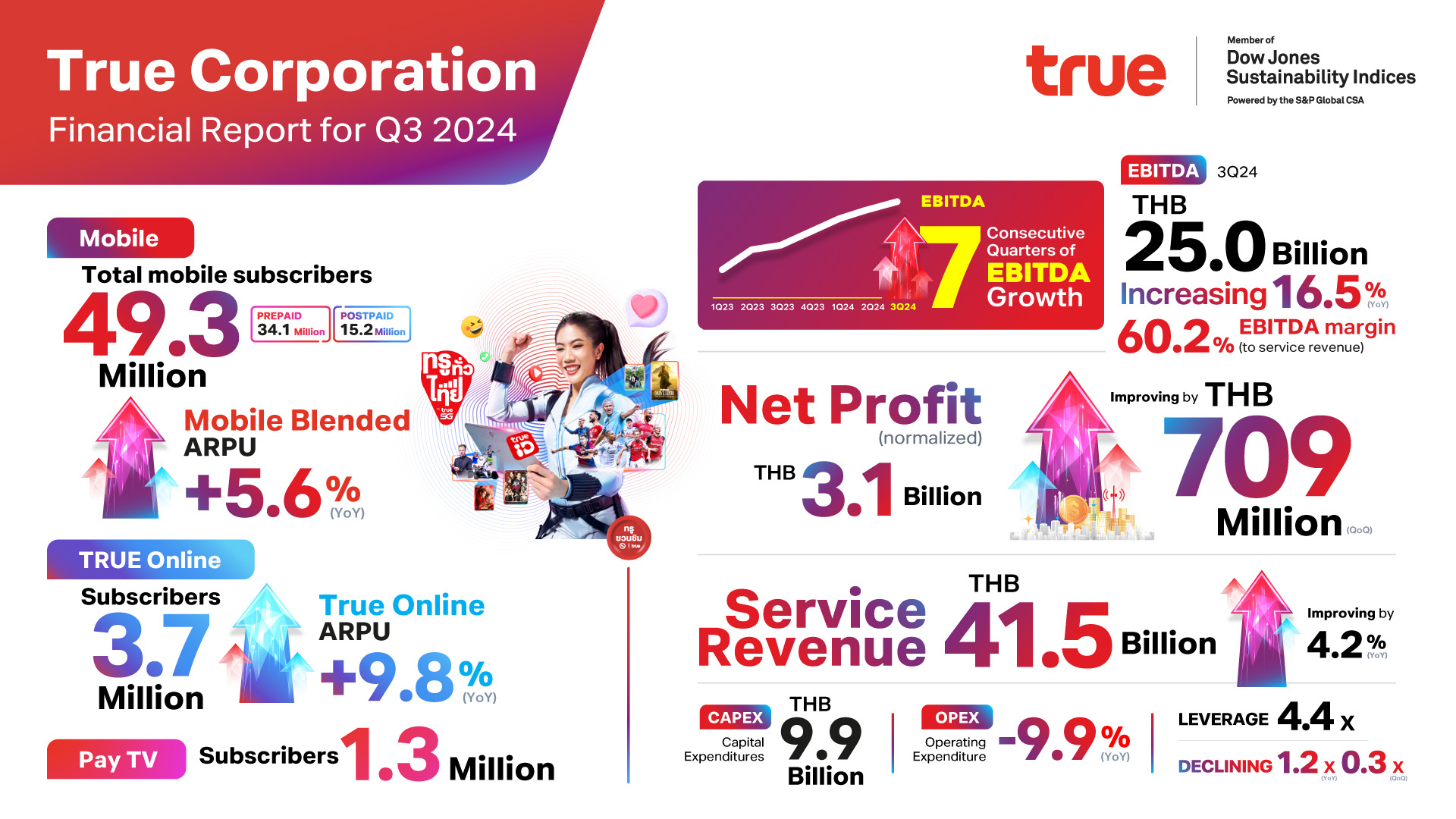

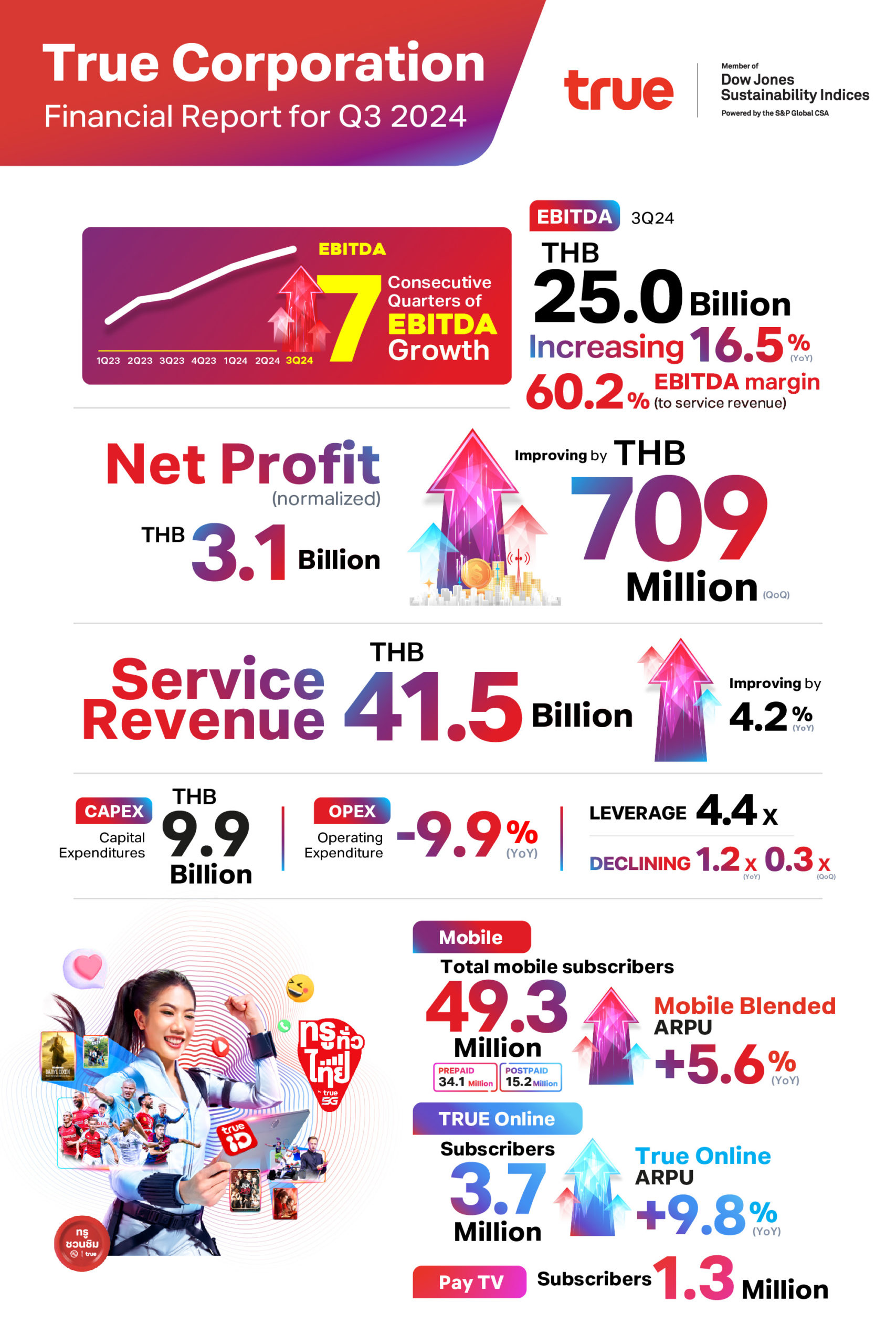

October 25, 2024 – True Corporation Plc. reported continued profitability for Q3 2024, recording THB 3.1 billion in Normalized Net Profit After Tax. EBITDA improved for the seventh consecutive quarter, driven by reduction in operational expenses from performance focus and improved efficiency along with ongoing benefits from synergies.

Mr. Manat Manavutiveth, Chief Executive Officer of True Corporation Plc., said, “In Q3 2024, True Corporation continued to achieve growth despite economic challenges domestically and regionally, as well as flooding in most provinces. Our network investments ensured strong preparedness, resilient operations and robust connectivity in affected areas. We also dedicated resources to supporting impacted customers and communities. The continuous growth in EBITDA for the seventh consecutive quarter demonstrates our ability to improve operational efficiency in challenging circumstances, with a focus on effective cost management and the integration of artificial intelligence to enhance both internal processes and customer service. We remain committed to continuous innovation, ensuring that the company best meets the needs of our customers.”

Mr. Sharad Mehrotra, Deputy Chief Executive Officer of True Corporation Plc., said, “In Q3 2024, we continued to focus on improving our customers’ experience by investing nearly 10 billion baht, mainly focusing on network modernization. We have now modernized over 10,000 stations out of a total of 17,000. Furthermore, we are integrating artificial intelligence with deep customer insights to transform our services, enhance business operations, and empower the digital lifestyles of our customers. Additionally, we are proud to be the first in Thailand to adopt the Responsible AI Maturity Roadmap by the GSMA, ensuring that our use of AI is ethical and aligned with global standards.”

In Q3 2024, ongoing focus on quality acquisition resulted in negative net adds of mobile subscribers, declining by 1.2 million, or 2.3% from the previous quarter, reaching 49.3 million. Mobile Postpaid subscribers decreased QoQ to 15.2 million while prepaid subscribers reached 34.1 million. Online subscribers registered an increase of 0.6% QoQ, reaching 3.7 million. At the end of Q3 2024, 5G subscribers reached 12.4 million, growing by 5.4% QoQ.

Mr. Nakul Sehgal, Chief Financial Officer (Co) of True Corporation Plc., said, “True Corporation has now achieved seven consecutive quarters of growth in EBITDA, resulting in improved normalized profit of THB 3.1 billion in the third quarter of 2024. Service revenue excluding IC registered a growth of 4.2% YoY, driven by growth in mobile and online business segments. Consolidated total revenue reached THB 50.8 billion, improving 1.4% YoY mainly driven by growth in service revenue across all business segments.”

Our ongoing efforts at integrating performance management in our company’s culture has resulted in ARPU improvement across all business segments compared to the previous year. Mobile service revenue improved 3.7% YoY owing to blended ARPU increase of 5.6% YoY. Online service revenue increased 7.5% YoY driven by continued ARPU uplift of 9.8% YoY. PayTV revenue improved 0.9% YoY with ARPU improvement of 1.8% from last year.

For Q3 2024, total operating expenses excluding depreciation and amortization declined 9.9% YoY, benefitted by realization of synergies and ongoing efficiency measures. Network cost declined 13.3% YoY driven by continued synergy related savings from network modernization & procurement. SG&A declined 17.7% YoY benefitted by synergies from commercial and organization modernization initiatives. Through acceleration of key synergy areas and granular focus on structural efficiency initiatives, True Corporation has consistently kept operating expenses well controlled.

True Corporation recorded an EBITDA improvement of THB 5,530 million since the amalgamation, marking seven consecutive quarters of EBITDA growth. For the third quarter of 2024, EBITDA improved by THB 646 million from the previous quarter, increasing 2.7% QoQ. EBITDA to service revenue improved to the highest level since amalgamation at 60.2% in Q3 2024.

In Q3 2024, True Corporation recorded an impairment of redundant assets related to network modernization and booked one-time costs amounting to THB 3,917 million resulting in a Net Loss After Tax of THB 810 million. Normalizing for the one-time effects, Net Profit After Tax amounted to THB 3,107 million, an improvement of THB 709 million from the previous quarter, mainly driven by improvement in EBITDA. CAPEX for the third quarter of 2024 amounted to THB 9,919 million, mainly focusing on network modernization.

The guidance for True Corporation for 2024 remains unchanged, where the Company expects to deliver 4 – 5% YoY growth in service revenue excluding interconnection, 12 – 14 % YoY growth in EBITDA, while CAPEX including integration capex guidance remains unchanged at THB 30 billion. Full year 2024 will remain profitable excluding any write offs for redundant network assets pertaining to network modernization initiatives.

Key financial indicators in Q3 2024

- Service revenue excluding IC: THB 41,509 million, improving 4.2% YoY and remaining flat QoQ

- EBITDA: THB 24,981 million, increasing by 16.5% YoY and 2.7% QoQ

- EBITDA margin (to service revenue): 60.2%

- Net profit (normalized): THB 3,107 million, improving by THB 709 million QoQ

About True

As Thailand’s leading telecom-tech company, True Corporation empowers people and businesses with connected solutions that advance society sustainably. True’s world-class voice and data services enable a lifestyle ecosystem of global entertainment, exclusive privileges, and seamless connectivity. Through our AI-augmented innovation, we contribute to a more productive, healthier, and safer world.