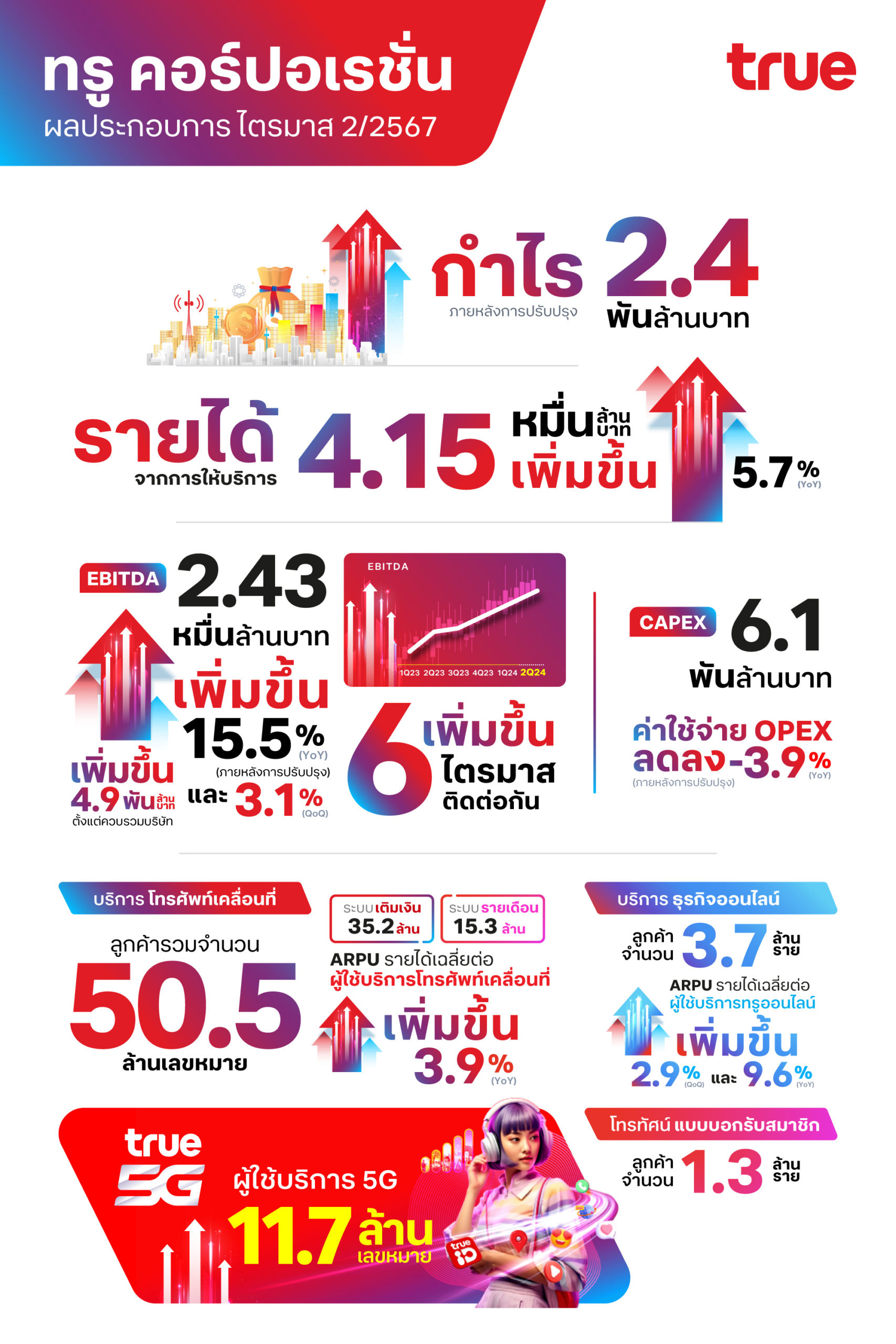

August 2, 2024 – True Corporation Plc. reported continued profitability for Q224, recording THB 2.4 billion in Normalized Net Profit After Tax. EBITDA improved for the sixth consecutive quarter driven by higher service revenue from mobile and online segments while operational expenses reduced from performance focus and improved efficiency. The company also emphasized its transformation into a Tech-Telco entity, focusing on AI implementation and complete work process automation by 2027.

- In Q224, True Corporation recorded an impairment of redundant assets related to network modernization and booked one-time costs amounting to THB 4,277 million resulting in a Net Loss After Tax of THB 1,879 million. Normalizing for the one-time effects, Net Profit After Tax amounted to THB 2,398 million, an improvement of THB 1,596 million from the previous quarter, driven by improvement in EBITDA and lower depreciation & amortization. CAPEX for the second quarter of 2024 amounted to THB 6,112 million, with investment focused on network modernization and enhancement of customer experience.

Mr. Manat Manavutiveth, Chief Executive Officer of True Corporation Plc., revealed, “Since our merger last year, True Corporation has focused relentlessly on creating continuous growth to achieve our objective of becoming a sustainably growing tech company. We prioritize leveraging technology to maximize customer satisfaction. Our Q2 performance aligns with our merger plan, with revenue growing steadily and EBITDA showing growth for the sixth consecutive quarter.”

Mr. Manat outlined the company’s vision and roadmap, “We have laid out the sustainable telco-tech leader roadmap, offering sustainable profitability and value creation through experience, growth, and synergies by 2025. To achieve 2024 profitability, we are focusing on these three key areas. 2024 is our year to transform for profitable growth, while 2025 will be the year for sustainable profitability and value creation for our customers, the industry, the markets, and the entire country.”

Mr. Sharad Mehrotra, Deputy Chief Executive Officer of True Corporation Plc., disclosed plans to elevate customer experience and prepare for the future: “We’re accelerating our network modernization, having already upgraded over 7,100 out of 17,000 sites, resulting in improved Net Promoter Scores (NPS). We’ve established a Customers & AI Group to enhance service delivery with cutting-edge technology.”

Mr. Sharad continued, “Network modernization remains our top priority. We’re implementing a 360° granular-level strategy to enhance customer experience, aiming to double our 5G top speed through a superior network with the widest coverage. True Corporation intends to invest in network modernization and automated back-end systems to drive digitalization across the organization, enabling True to become a Tech-Telco company. Out of our 59,000 network towers, 17,000 will be modernized with a gradual upgrade plan of 10,000 by 2024, and the remaining will be completed in 2025. The more we modernize, the better the experience for our customers.”

In Q224, emphasis on quality acquisition has resulted in negative net adds of mobile subscribers, declining by 0.6 million, or 1.2% from the previous quarter, reaching 50.5 million. Mobile Postpaid subscribers remained flat QoQ at 15.3 million. Online subscribers registered marginal increase of 0.1% QoQ, reaching 3.7 million.

Mr, Nakul Sehgal, Chief Financial Officer (Co) of True Corporation Plc., said, “I am pleased to report the sixth consecutive quarter of EBITDA improvement for True Corporation, resulting in sustained normalized profit of THB 2.4 billion in the second quarter of 2024. Service revenue excluding IC registered a growth of 5.7% YoY, driven by strong performance management across business segments. Consolidated total revenue reached THB 51.1 billion, improving 4.4% YoY mainly driven by uplift in service revenue.”

Mobile service revenue improved 5.2% YoY owing to blended ARPU increase of 3.9% YoY. Online service revenue increased 5.5% YoY driven by continued ARPU uplift of 9.6% YoY. PayTV revenue improved 7.0% YoY from higher music and entertainment while subscription revenue remains under pressure.

For Q224, total operating expenses excluding depreciation and amortization declined 3.9% YoY normalized for one-time positive effects in Q223, mainly driven by achievement of synergies arising from the amalgamation. Network cost declined 7.6% YoY from savings on account of network modernization and lower energy tariff. Further, SG&A decreased 14.2% YoY benefitted by synergies from commercial and organization modernization initiatives. Through performance driven mindset integration into the organization’s culture and structural efficiency initiatives, True Corporation continues to keep operating expenses well controlled.

True Corporation recorded an EBITDA improvement of THB 4,883 million since the amalgamation, marking its sixth consecutive quarter of EBITDA growth. For Q224, EBITDA improved by THB 733 million from the previous quarter, increasing 3.1% QoQ. Normalized for one-time positive effects in Q223, EBITDA improved 15.5% YoY, on account of topline growth and realization of synergies. EBITDA to service revenue improved to the highest level since amalgamation at 58.6% for Q224.

In Q224, True Corporation recorded an impairment of redundant assets related to network modernization and booked one-time costs amounting to THB 4,277 million resulting in a Net Loss After Tax of THB 1,879 million. Normalizing for the one-time effects, Net Profit After Tax amounted to THB 2,398 million, an improvement of THB 1,596 million from the previous quarter, driven by improvement in EBITDA and lower depreciation & amortization. CAPEX for the second quarter of 2024 amounted to THB 6,112 million, with investment focused on network modernization and enhancement of customer experience.

The management of True Corporation has revised its guidance for 2024. For the full year of 2024, the Company expects to deliver 4 – 5% YoY growth in service revenue excluding IC, 12 – 14 % YoY growth in EBITDA, while CAPEX including integration capex guidance remains unchanged at THB 30 billion. Full year 2024 will remain profitable excluding any write offs for redundant network assets pertaining to network modernization initiatives.

Key financial indicators in Q2 2024

- Service revenue excluding IC : THB 41,529 million, improving 5.7% YoY and 0.6% QoQ

- EBITDA : THB 24,335 million, increasing by 9.0% YoY and 3.1% QoQ

- EBITDA margin (to service revenue) : 58.6%

- Net profit (normalized) : THB 2,398 million, improving by THB 1,596 million QoQ

Disclaimer:

Total Access Communication Public Company Limited and True Corporation Public Company Limited have amalgamated into a new company under the name True Corporation Public Company Limited on 1st March 2023. The financial information reflecting prior periods in this document is based on pro-forma financial statements of Total Access Communication Public Company Limited and True Corporation Public Company Limited.