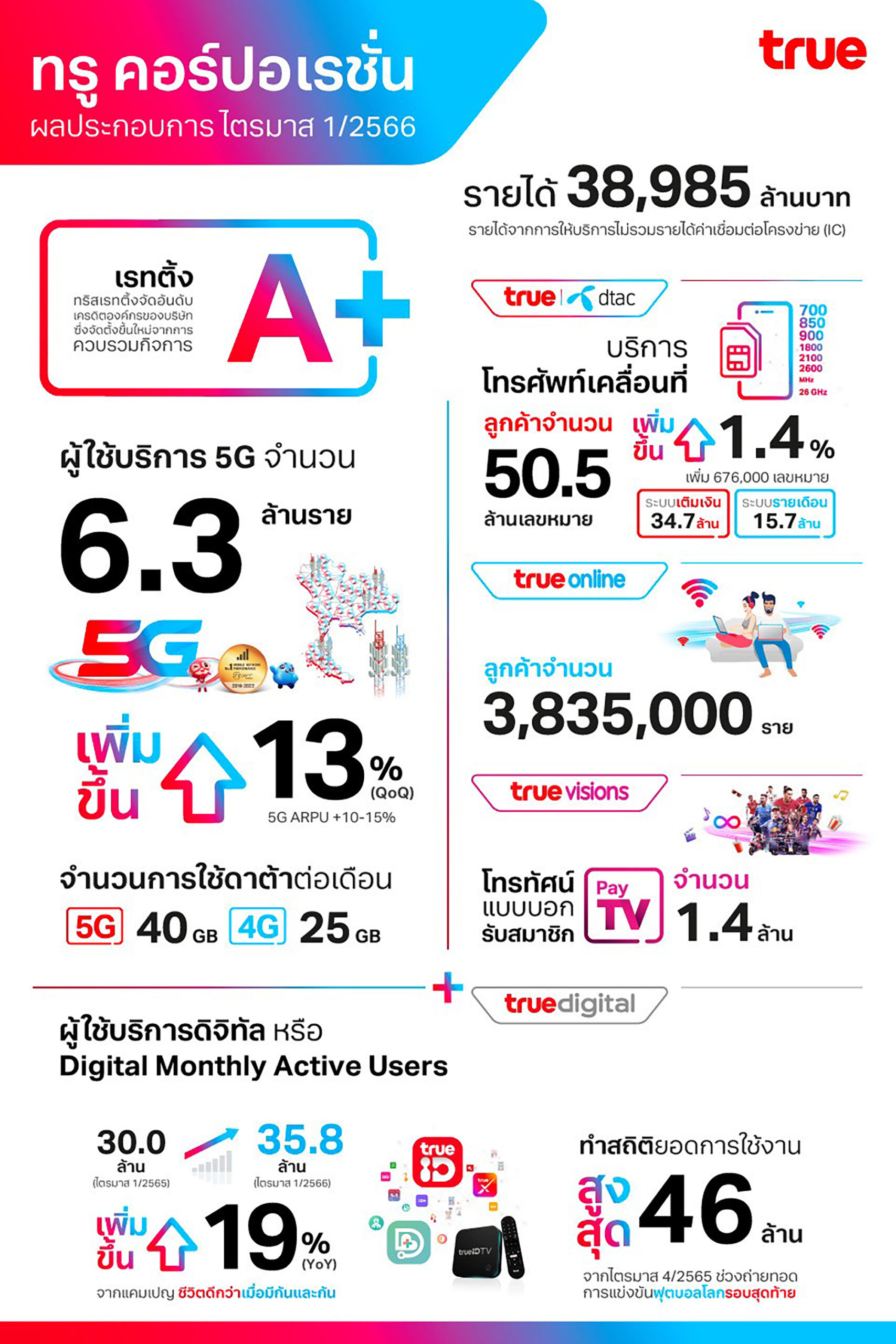

Bangkok, 10 May 2023 –True Corporation PLC (TRUE) was assigned an “A+” rating, reflecting the credit profile as the newly formed entity as the result of the amalgamation.

Manat Manavutiveth, True Corporation’s Chief Executive Officer, said, “2023 marks a milestone achievement for our company as we complete the amalgamation between Total Access Communication Plc. and True Corporation Plc. The new True Corporation Plc. embarked on its journey to become the telecom-tech leader of Thailand, committing to the highest governance standard, fostering a digital ecosystem and inclusive society for all. As a result of the amalgamation, customers of dtac and True are now benefiting from improved network quality, and access to high speed 5G with 2600 MHz and better 4G/5G coverage on 700 MHz in all 77 provinces of the country. Customers are also able to enjoy a higher and more diverse range of products and services as well as privileges offered under both brands, leading to cross-selling and upselling opportunities. Since the completion of the amalgamation, True Corporation has successfully established a single organization structure and way of work, enabling the execution of our integration plan and achievement of short-term synergies.”

True Digital Solutions revenue increased 92% YoY, mainly driven by smart solutions, and scalability to various industries. Integrated Digital Health delivered 62% YoY revenue growth, accelerating growth and ecosystem by entering partnerships with insurance providers and collaborating with hospitals to provide easier and convenient access to medical services.

The macroeconomic recovery of Thailand continues to be benefitted by improving tourism, however, inflation rates remained high. An upward revision of energy prices caused further cost pressure on businesses and consumers alike. The competition aggression marginally improved as the industry players are focusing more on providing higher value products, service bundling, and lifestyle solutions for customers. Despite the external hurdles, the new True Corporation remains committed to delivering on its strategic priorities, executing on integration plans and attaining synergies.

During Q123, mobile subscribers increased by 676,000 to 50.5 million, registering a growth of 1.4% from Q422. 5G subscribers reached 6.3 million registering a growth of 13% QoQ with improved usage and visible 5G ARPU uplift of 10-15%. Digital monthly active users (MAU) reached 35.8 million, increasing by 19% YoY driven by the Better Together cross-selling campaign after the completion of the amalgamation. In Q422, digital MAU reached an all-time high of 46.0 million users driven by the FIFA World Cup streaming.

A result of the amalgamation, customers of dtac and True are now benefiting from improved network quality, and access to high speed 5G with 2600 MHz and better 4G/5G coverage on 700 MHz in all 77 provinces of the country. Customers are also able to enjoy a higher and more diverse range of products and services as well as privileges offered under both brands

Nakul Sehgal, True Corporation’s co-Chief Financial Officer, said, “Our service revenue development continued to be under pressure from lower ARPU from prolonged impact competition aggression. In the first quarter, consolidated service revenue declined by 2.0% YoY due to lower contribution from mobile and online segments. Mobile service revenue declined 2.5% YoY due to ARPU erosion despite subscriber growth. Online service revenue declined 2.3% YoY negatively impacted by declining consumer broadband sales amidst intensifying competitive offers, partly offset by growth in corporate sales. Product sales revenue declined 28.9% YoY due to lower volume of handsets sold and early launch of iPhone in Q322.

On a pro forma financial basis for the first quarter of 2023, total OPEX excluding D&A declined by 5.2% YoY due to ongoing efficiency measures despite higher inflation and higher utility costs. EBITDA for the quarter improved by 10.1% QoQ due to one-time effect from contract negotiation in Q422, favorable settlement of an ongoing litigation in Q123, and well managed costs. Net Loss was reported at THB 492 million impacted positively by foreign exchange gain and partial settlement of insurance claim. Net loss in Q422 was negatively impacted by non-recurring expenses of ~THB 8.5 Bn mainly due to write down of assets, amalgamation costs and annual impairment. CAPEX in Q123 amounted to THB 17,565 million with focus on improving experience and capacity expansion prior to amalgamation. With the upgraded “A+” rating of True Corporation, the interest expenses are expected to gradually reduce as old debts mature and are refinanced under the new rating.”

True Corporation will continue to accelerate the realization of revenue synergies by utilizing the cross selling and upselling opportunities while structurally focusing on efficiency measures. Delivering on expected synergies remains key for sustainable future growth. For FY 2023 outlook, True Corporation Plc. expects to deliver a flat service revenue excluding IC and flat to low single digit decline on EBITDA. Capital expenditure levels are expected to be between THB 25 – 30 billion. The guidance for 2023 accounts for the 10 months of operations from the date of the amalgamation. Guidance for the year is reserved considering the large-scale transformation of True Corporation’s business and operations post-amalgamation as well as integration related expenses.

Key financial indicators in Q1 2023 (on a pro forma basis)

- Service revenue excluding IC – THB 38,985 million, declining 2.0% YoY

- EBITDA – THB 19,452 million, declining by 8.7% YoY

- EBITDA to total revenue – 37.5%

- Net loss – THB 492 million