(Bangkok, 26 September 2023) At their Capital Markets Day today, the Management of True Corporation revealed synergies of THB 250 billion in Net Present Value (NPV). The management also outlined details of key areas contributing to the synergies, with 35% delivered by the network consolidation project “Single Grid”. EBITDA growth will surpass Service Revenue growth as the company focuses on profitable growth while undergoing a large-scale transformation. True Corporation expects to achieve steady state cashflow savings of approximately THB 22 billion from 2026.

Manat Manavutiveth, True Corporation’s Chief Executive Officer, said, “True Corporation represents the largest telecom amalgamation in Asia in terms of enterprise value. Together we benefit from the experience and strengths of our shareholders, with CP Group bringing Thai market expertise, a wide variety of business and channels in their portfolio and a diverse and widespread distribution footprint. From Telenor Group, we gain the expertise of Telecommunications, with operational performance and profit driven focus. We are leading Thailand’s mobile market with over 51 million subscribers while serving 3.8 million online users and 40 million digital users. We are transforming ourselves from Telecom to Telecom-Tech, by combining our core connectivity and business capabilities with advanced technologies. By extending our capabilities to consumers, businesses, and industries, we will generate new growth opportunities beyond connectivity and deliver on our vision to lead Thailand’s Telecom-Tech frontier.”

Sharad Mehrotra, True Corporation’s Deputy Chief Executive Officer, said, “Our network consolidation project, Single Grid, will be the core of our operations, as we integrate by reducing redundant infrastructure by 30%, yet building a denser, wider, and better network for our customers. We will focus on granular level execution, reducing coverage gaps, while strengthening and modernizing our towers with multiple bands. As we integrate our networks, our key priority will be ensuring good customer experience through band-wise execution, creating overlapping coverage and utilizing real-time insights. With the support of world-class vendors and partners, we aim to deliver the Single Grid within 2025.

We will also create value for our customer base through product differentiation with a wide range of service propositions that cater to customer preferences and using next-generation AI and enhanced capabilities, while using channel harmonization to provide seamless online-offline experience. 5G monetization, upselling and cross selling of convergence offerings, premiumizing of customers with digital services and ongoing rationalization of offers in the market will be the key levers for sustainable growth.”

Nakul Sehgal, True Corporation’s Co-Chief Financial Officer, said, “Over 100 initiatives contribute to the THB 250 billion synergies, with the top 15 driving 85% of all synergy values. The bulk of the integration related spending will be taking place by 2024, as a result of which the company will achieve net positive synergies in 2025, becoming profitable. True will realize steady state cashflow savings of approximately THB 22 billion from 2026 onwards.

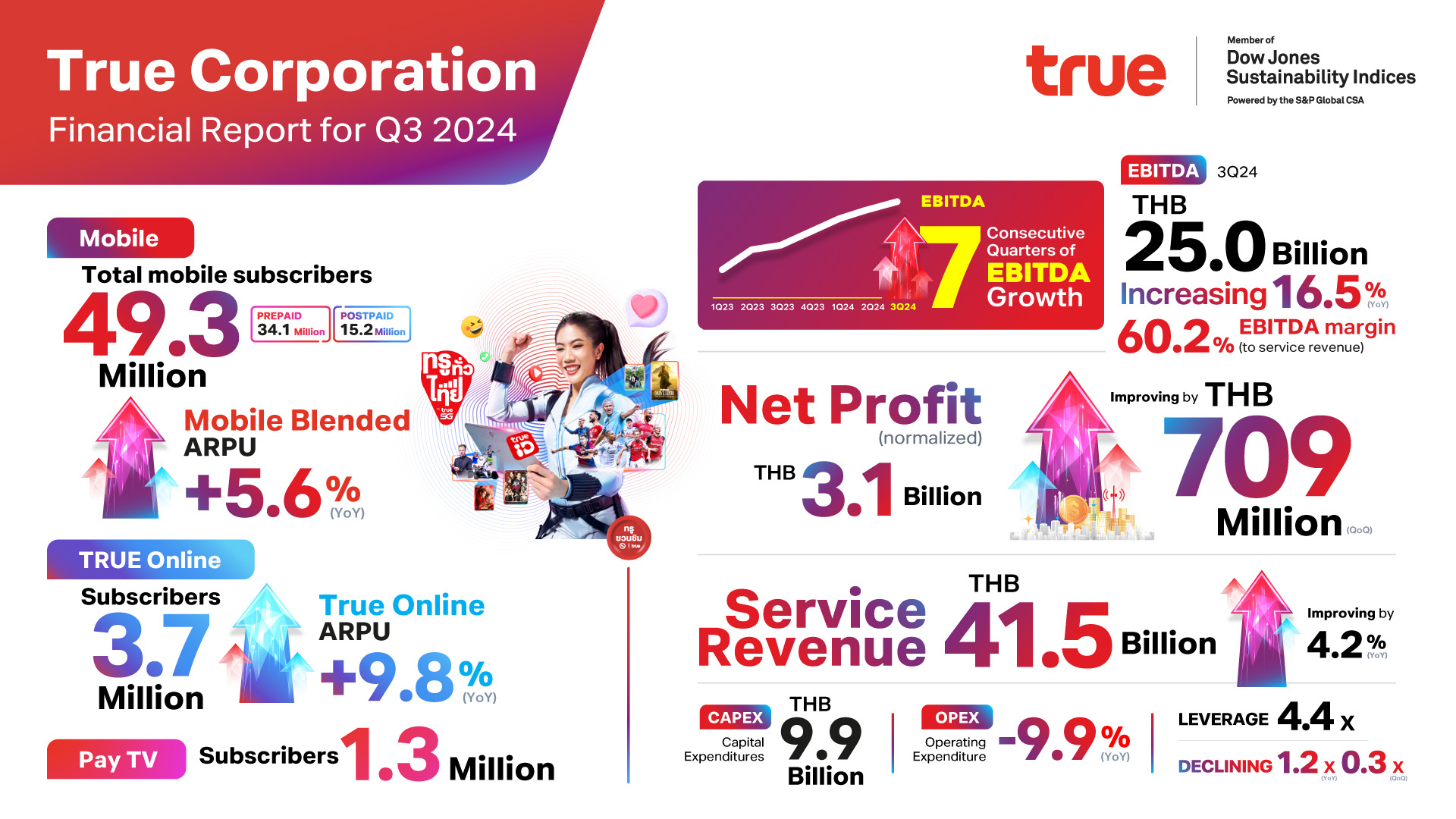

With continued focus on structural optimization of costs, sweating of assets and profitable growth, EBTIDA will grow faster than Service Revenue, with EBITDA to Service Revenue Margin expected to improve 11 pp by 2027. Benefiting from procurement synergies and Single Grid including spectrum pooling, disciplined capex management which has been engrained in our way of work, the CAPEX intensity of True is expected to be half of pre-amalgamation levels after the completion of network consolidation. As a leading technology provider with competitive edge from the strengths of our shareholders, True Corporation is well positioned in Thailand to grab untapped opportunities and deliver value for all stakeholders.”

For FY 2023 outlook, True Corporation Plc. has indicated the following guidance for 2023 accounting for 10 months of operations from the date of the amalgamation:

- Flat Service Revenue (excluding IC)

- Low-to-mid single digit growth in EBITDA

- CAPEX of THB 25 – 30 billion