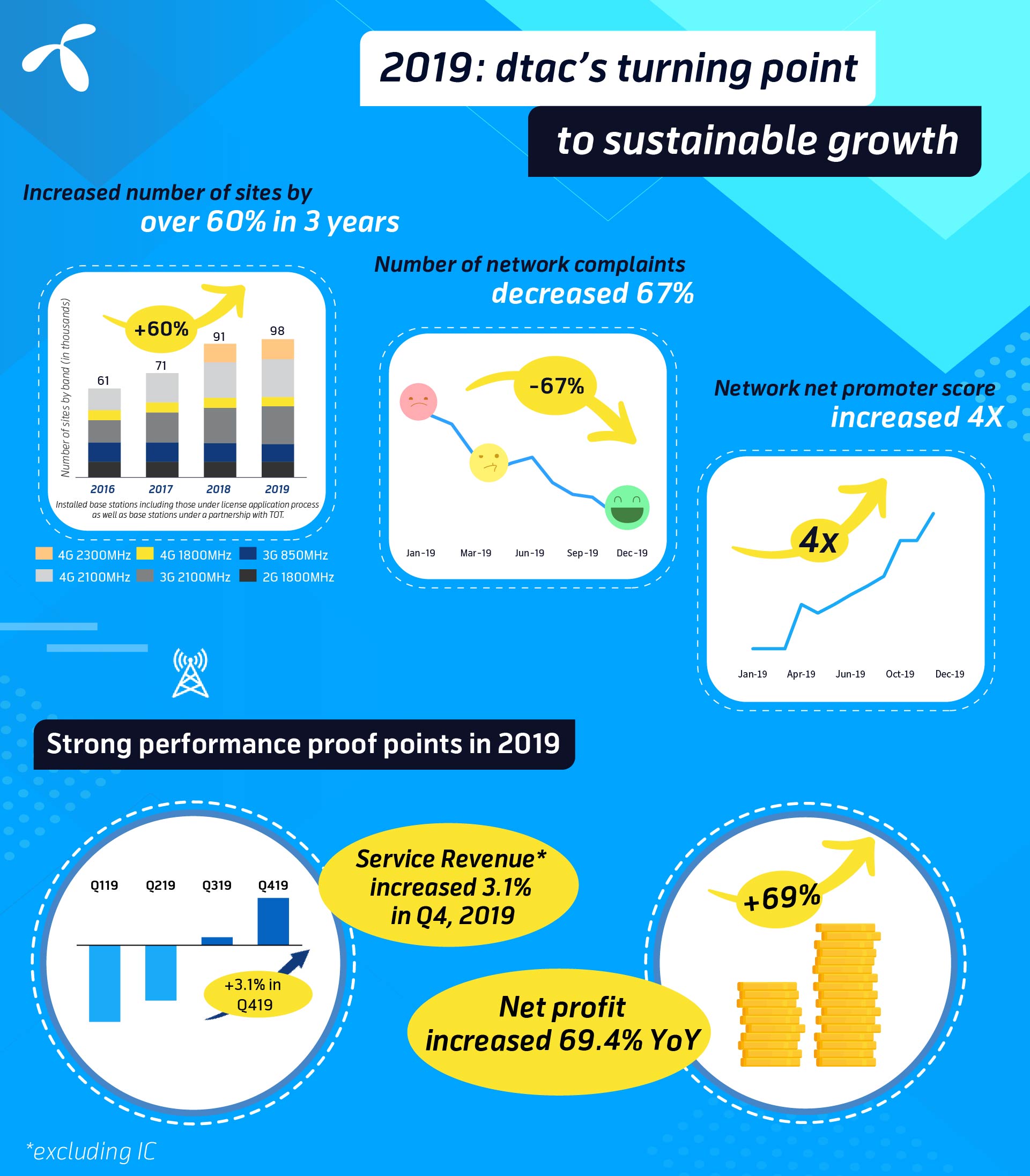

28 January 2020 – Total Access Communication PLC. or dtac reported strong performance in 2019 with year-on-year growth in quarterly service revenues excluding IC in both Q319 and Q419 as well as significant net profit improvement year-on-year in 2019. The strong performance was mainly driven by consistent network improvements and better customer experience.

Alexandra Reich, dtac’s Chief Executive Officer, said “The results in 2019 gave us a comfort that we are back on the path to sustainable growth. Our customer experience has significantly improved from our customer-centric network optimization. Our customers, both prepaid and postpaid, are responding well to our network improvements, our revitalized distribution as well as our efforts to create a more personalized user experience. Our strategic focus for 2020 will be on never-stop improving customer experience, further strengthening our network and readying the organization for the future.”

Throughout the year, dtac has worked consistently to improve the quality and footprint of its mobile network. In 2019, approximately 4,700 base stations on TOT’s 2300MHz were added, bringing the total number of 2300MHz base stations to approximately 17,400.

At the end of 2019, total subscriber base stood at 20.6 million with a subscriber loss of 560,000 during the year. Service revenues excluding IC for Q419 increased 3.1% YoY while core service revenues for 2019 increased 0.1% YoY, driven by improved prepaid subscriber development with positive net additional prepaid subscribers in Q419 and continuous growth in postpaid segment. Net profit for 2019 amounted to THB 5.9 billion, increasing 69.4% YoY from lower regulatory and amortization expenses of assets under concession.

Dilip Pal, dtac’s Chief Financial Officer, said “We had strong financials with year-on-year growth in service revenues excluding IC yet again in Q419 and year-on-year growth in core service revenues (defined by bundle of voice and data service revenues) in 2019. With lower regulatory and amortization expenses of assets under concession and well controlled cost of services and SG&A expenses, we managed to get a significant net profit improvement year-on-year.”

dtac gives its guidance on service revenue excluding IC development for 2020 at a low single-digit growth with mid single-digit EBITDA growth and capital expenditure of THB 13 – 15 billion.

Key financial indicators in 2019 (Pre-TFRS 15 & 16 and excluding impacts from CAT settlement in 2018)

- Service revenue excluding IC – THB 62.1 billion, declining 1.6% YoY

- EBITDA – THB 25.7 billion, declining 9.3% YoY

- EBITDA margin (normalized) – 35.6%

- Net profit – THB 5.9 billion, growing 69.4% YoY